Navigating the Future of Finance: A Guide to Crypto Coin and Fund Investments

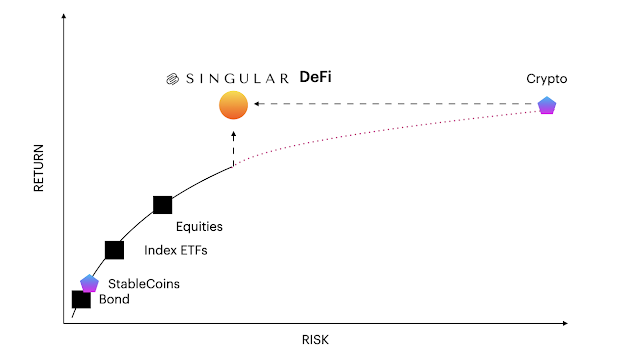

The landscape of investment has undergone a seismic shift with the advent of cryptocurrencies. Gone are the days when stocks and bonds were the only options for investors. Today, we stand at the precipice of a new era, one dominated by digital currencies and blockchain technology. This article aims to shed light on two key investment avenues in this burgeoning field: crypto coin investment and crypto fund investment. The Rise of Cryptocurrencies: A New Dawn for Investors Cryptocurrencies, or digital currencies, have taken the world by storm. These decentralized forms of currency, secured by cryptography, offer a level of security and anonymity previously unseen in the financial world. The most well-known of these, Bitcoin, has become synonymous with the term "cryptocurrency." However, the crypto landscape is vast, with thousands of coins, each with its own unique features and potential for growth. Understanding Crypto Coin Investment Crypto coin investment refers to the dire...