The Revolution of Crypto Trading: Independent Hedge Funds

The world of cryptocurrency trading has evolved dramatically in recent years, with innovative technologies and financial instruments continually reshaping the landscape. One such innovation that has gained significant traction is the concept of Independent Hedge Funds. In this article, we will explore what Independent Hedge Funds are and how they are revolutionizing the world of crypto trading.

What is an Independent Hedge Fund?

An Independent Hedge Fund is a novel financial model that leverages blockchain technology and smart contracts to create a trustless, transparent, and democratic investment platform. Unlike traditional hedge funds, which are centralized and often require intermediaries, Independent Hedge Funds operate on decentralized networks like Ethereum, Binance Smart Chain, and others. These funds are governed by smart contracts, which are self-executing contracts with predefined rules and conditions.

The primary objective of an Independent Hedge Fund is to generate returns for its investors by actively managing cryptocurrency assets. However, what sets these funds apart is their decentralized nature, which eliminates the need for intermediaries, reduces fees and enhances transparency. This approach democratizes the investment process, allowing anyone with an internet connection to participate.

Critical Benefits of Independent Hedge Funds for Crypto Trading

- Transparency: Independent Hedge Funds operate on blockchain networks, making all transactions and fund activities transparent and traceable. This level of transparency builds trust among investors and eliminates the risk of fund managers engaging in fraudulent activities.

- Lower Fees: Traditional hedge funds often charge high management and performance fees. In contrast, Independent Hedge Funds typically have lower fees since they eliminate intermediaries and automate processes through smart contracts. This means more of the profits go to the investors.

- Accessibility: Independent Hedge Funds are open to anyone with an internet connection, leveling the playing field for both retail and institutional investors. This accessibility allows a broader range of investors to participate in crypto trading strategies that were once reserved for the elite.

- Security: Blockchain technology provides a high level of security for investors' funds. Smart contracts execute investment strategies automatically, reducing the risk of human error or misconduct. Additionally, blockchain's immutability ensures the integrity of the fund's records.

- Liquidity: Independent Hedge Funds often provide better liquidity for investors, as they can quickly enter or exit their positions at any time without the constraints of traditional lock-up periods.

Applications of Independent Hedge Funds in Crypto Trading

- Algorithmic Trading: Independent Hedge Funds can utilize algorithmic trading strategies to execute buy and sell orders automatically based on predefined criteria. These algorithms can analyze market data, identify trends, and make rapid trading decisions, potentially maximizing profits for investors.

- Risk Management: Advanced risk management techniques, such as stop-loss orders and portfolio diversification, can be implemented through smart contracts. These measures help protect investors' capital and minimize potential losses.

- Yield Farming: Independent Hedge Funds can participate in yield farming protocols to generate additional returns for investors. Yield farming involves lending assets to decentralized platforms in exchange for interest or rewards.

- Tokenized Assets: Some decentralized hedge fund tokenize their assets, allowing investors to trade fund tokens on decentralized exchanges (DEXs). These tokens represent ownership in the fund and can be traded 24/7.

Conclusion

Decentralized hedge funds have emerged as a game-changer in the world of crypto trading. Their transparency, lower fees, accessibility, security, and liquidity make them an attractive option for both experienced and novice investors. These funds leverage blockchain technology and smart contracts to automate trading strategies and democratize investment opportunities.

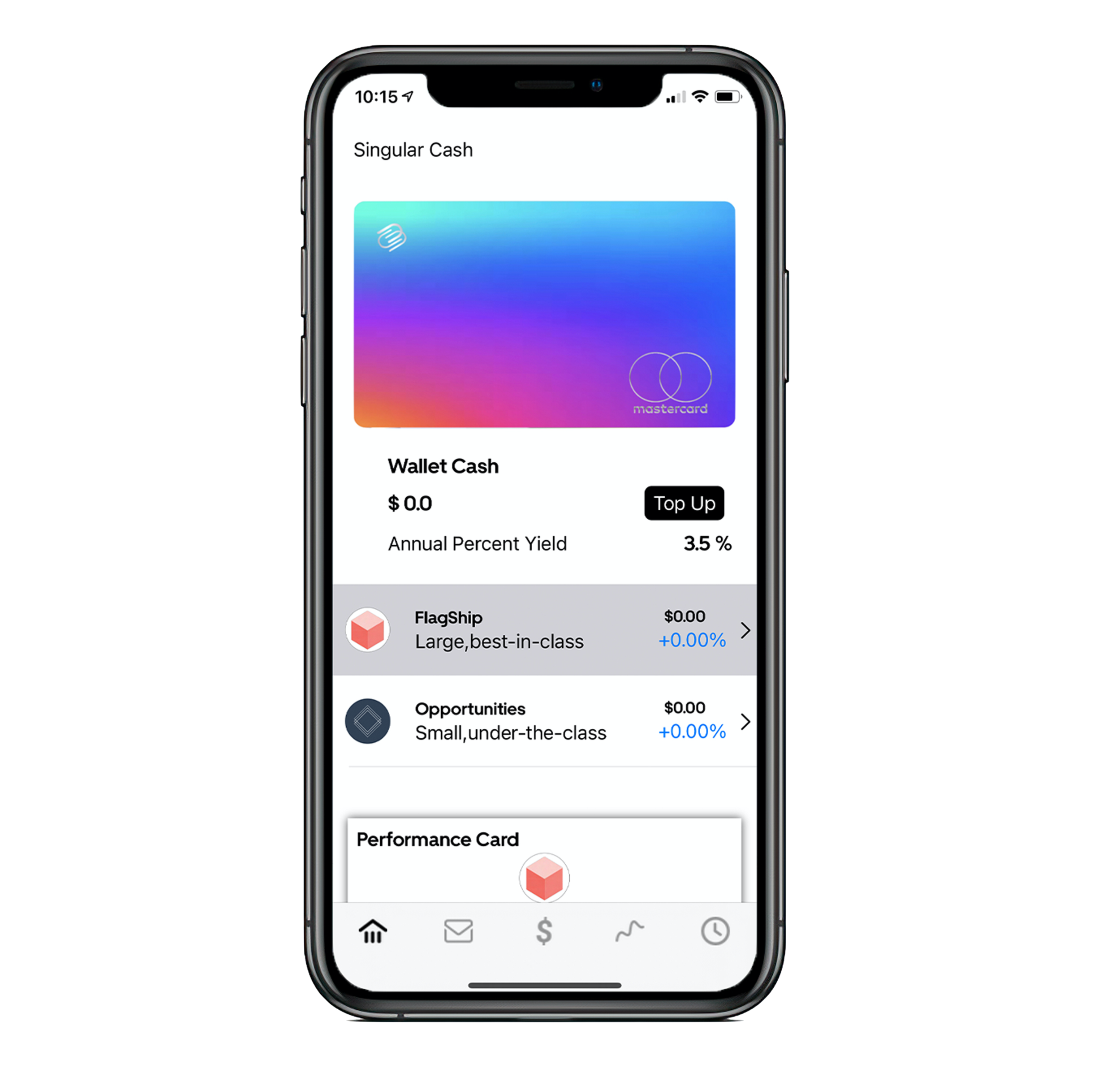

One company at the forefront of this revolution is SingularVest. This organization has been a pioneer in the field of decentralized hedge funds, offering a user-friendly platform that empowers investors to participate in the application for crypto trading with confidence.

Comments

Post a Comment